The Political School ‘Vivi nella comunità’ is a great opportunity for the relaunch of Italy: interview with Aldo Iaquinta

The importance of the first non-partisan and multidisciplinary Political School to train a more prepared ruling class, the role of training as a lever for the country’s development, financial education as a fundamental factor of social inclusion, the ongoing reorganization of the Italian insurance world and the its effects. Interview with Aldo Iaquinta, member of the Executive Board of the Political School ‘Living in the Community’ and CEO of Aimuw S.p.A., one of the most important insurance and reinsurance companies.

1. She is CEO of Aimuw spa, one of the largest insurance and reinsurance agencies in Italy and is a member of the executive board of the ‘Vivere nella Comunità’ Political School, the first non-partisan and multidisciplinary Political School in Italy. A school that aims to train a more prepared, aware ruling class characterized by a drive towards civil commitment in all its facets. What does it mean for you to be part of such a qualified, prestigious and one-of-a-kind training project?

“Being a member of the Executive Board of the Political School ‘Vivere nella Comunità’ is a great honor for me, not only as CEO of Aimuw but also as a professional who comes into contact every day with qualified people, such as those who the Political School it is hoped to form. The basic idea of the School, which was widely appreciated for its authority in the first edition and now also through the second edition, is to create a space for dialogue between experts in the relevant sectors in our country and those who are ready to grasp the stimuli and learn, enriching one’s personal background, the methods of realization and effectiveness in different working contexts. This means that the members of the Board, among whom I have the honor of joining, represent not only authoritative people but also a guide and an example for the participants for what the diversified professional possibilities are and how these can go from mere theoretical skills to concrete practical skills. I must say that the merit of the founders is precisely this, having created a truly unique place of reflection and learning in Italy. My compliments and thanks go to them”.

2. The Political School boasts some of the most important figures of our country such as Professors Cassese, Capaldo, Boccardelli, Cartabia, Profumo, Mattarella, together with Carlo Messina, Gabriele Galateri, Massimo Lapucci and many others. What do these extraordinary personalities represent for you and for the students who will attend the School?

“The teachers, like the members of the Board, represent the excellence of our country in their respective sectors. This means instilling credibility towards the training offer that the School aims to guarantee to participants and at the same time guaranteeing a high level of preparation on transversal topics which is difficult to find in a university course, which tends to be monothematic or in a generic training course . For the participants, consequently, these figures represent the opportunity to measure themselves with people with extremely high preparation and with whom having a direct dialogue constitutes an enrichment both from a training and reputational point of view. For the members of the Board, however, the teachers are the expression of the skills with which we fit into a framework of training offers similar to ours, but different because they are too aligned, for example like other political schools relating to a very specific political area. The objective is to have coherence and incisiveness for the objective for which we assume responsibility, that is, to train the new ruling class, and these figures therefore emerge as fundamental as they are able to summarize this aim”.

3. The Politics School is made up of a teaching body of the highest level: university professors, CEOs, company presidents, public administration executives, managers and professional experts. The watchword is multidisciplinarity, also in relation to topics relating to savings, finance and economics. You lead a holding company that operates in the insurance and reinsurance field and has been a point of reference for insurance intermediaries for over 20 years. In your opinion, what is the level of knowledge of young people today on these issues?

“Young people have gaps on these issues, and it is a fact. These gaps are not present so much from a theoretical point of view on the topics of finance and economics, but rather on the practical application of the theories. This happens because training in our country is incomplete or sectoral and basically theoretical. A greater investment in the training of young people would be desirable so that the ability to manage their own social skills, which consequently imply cultural abilities and apprehension of not only social but also economic phenomena that concern them, is made possible and spread to large sections of the population’.

4. Venendo ad Aimuw S.p.A, può spiegarci in concreto cosa fate e di cosa vi occupate? Fra l’altro lei ha da poco lanciato l’Aimuw consulting. Quali sono i vostri obiettivi e i prossimi progetti?

‘AIMUW S.p.A deals with insurance and reinsurance intermediation and represents the major insurance groups in Italy. At AIMUW we have a high specialization as regards public bodies, specialty lines (cyber risk, hail, sureties and credit); through its own online platform it offers personalized insurance products to affinity groups. As a group we have completed the offer to satisfy the needs of our already consolidated customers and to seize the opportunities of an increasingly advanced market. We have, in fact, established AIMUW consulting, whose mission is the precise analysis of risk as a service aimed at companies, and AIMUW Mutua, which will be operational in one of the sectors that in my opinion is strategic and of great development in the coming years, welfare”.

5. Your agency operates in collaboration with large Italian and foreign groups such as Allianz, Zurich, Cattolica Assicurazioni, Aviva, Liberty, Berkshire Hathaway, Net Insurance, Chubb, as well as Lloyd’s of London. What is the current situation of the Italian insurance and reinsurance market?

‘Today we can see a strong concentration and relative consolidation which make possible the increasingly greater positioning of large insurance groups present in Italy. In today’s insurance and reinsurance intermediation, there are new competitors who, with the contribution of capital, acquire or incorporate both groups and companies already operating on the market. This is a phenomenon that will inevitably have a significant impact on small and medium-sized companies in favor of large groups. Furthermore, this phenomenon captures our attention, since as AIMUW we tend to consolidate our position”.

6. In the Politics & Living in the Community School we talk a lot about financial and economic education given the collaboration protocol you have signed with FEduF, the foundation chaired by Stefano Lucchini which has recently launched a new prestigious board chaired by Marcello Presicci. How important are these issues?

“As already mentioned, transversal skills include financial and economic education as part of a range of skills useful for interpreting the dynamics of our times. These are difficult moments, made even more complex by the pandemic, and these moments must be interpreted with the right interpretations. FEduF is very committed to this and interesting synergies can be developed with the nearby School, and some of the results are already visible; for example, a protocol was created which aims to make our participants collaborate with the initiatives activated by FEduF for the purpose of raising awareness on the issues especially among young people, i.e. those who must immediately familiarize themselves with financial instruments. In this sense, the School’s projects are different, the skills of the participants are certainly present and the feedback received so far from the outside is notable. The goal is to continue along this line and work not only for more widespread financial education, but to consolidate the ability to live in a community. Financial education is not only a vehicle for individual well-being, but is a tool for social inclusion and market functionality: it is something indispensable for the country system on which we must continue to work together, both public and private”.

Altri Articoli

CIG Event in Bologna

Evento CIG Bologna AIMUW also supports the second appointment of the UNI CIG 2024 Forum,…

UNI CIG 2024 FORUM

UNI CIG 2024 FORUM The first meeting of the UNI CIG 2024 FORUM dedicated to…

Events AIMUW 2023

È stato un fine anno di momenti di incontro e di confronto di avvio di…

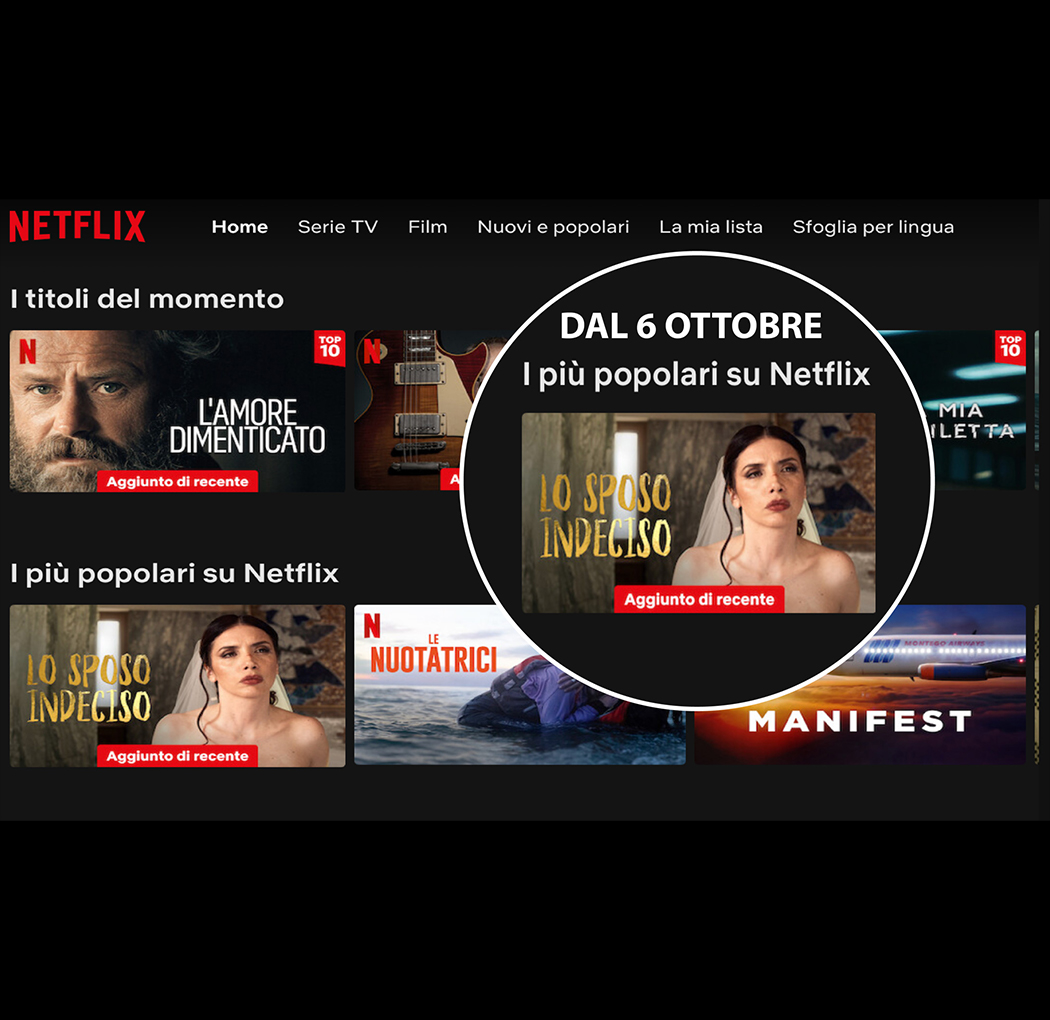

AIMUW at the Cinema and on Netflix with the film “Lo Sposo Indeciso”

A new experience for AIMUW S.p.A. thanks to Europictures we were partners for the insurance…